ABSTRACT

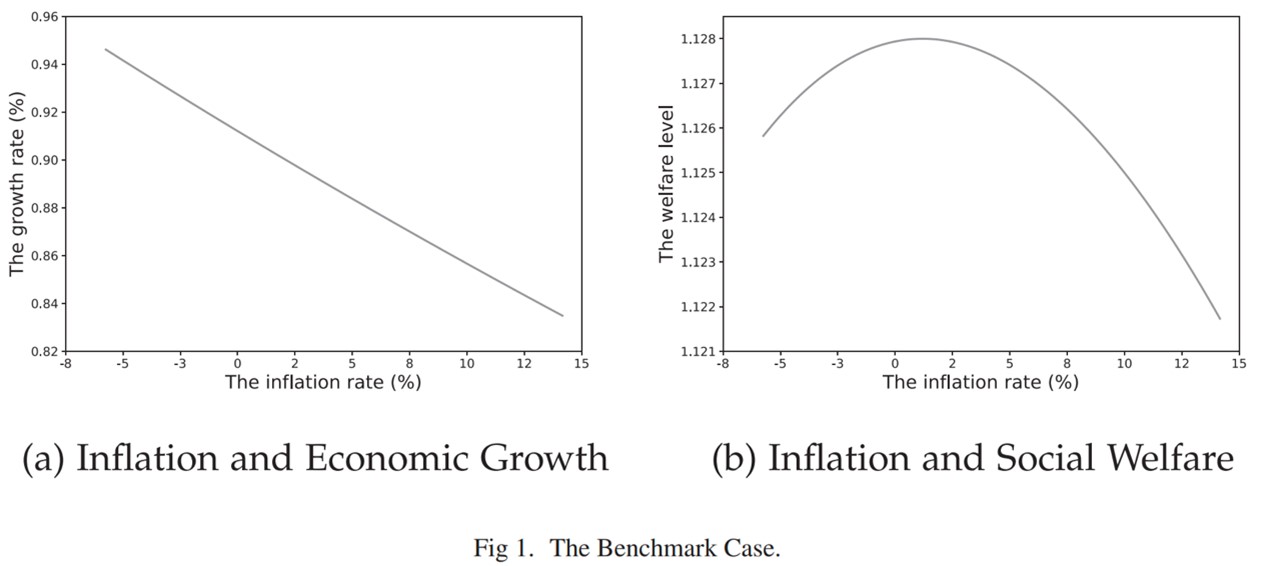

We explore the growth and welfare effects of monetary policy in a Schumpeterian economy with cash-in-advance (CIA)-constrained research and development (R&D) investment in both the upstream and downstream sectors. We show that the nominal interest rate can have an inverted-U relation with economic growth due to its effects on labor allocations between manufacturing and R&D and between the R&D sectors. Furthermore, aggregate R&D overinvestment is generally sufficient but not necessary for the Friedman rule of zero nominal interest rates to be suboptimal. Calibrated using data from U.S. manufacturing firms, our model features a positive welfare-maximizing nominal interest rate despite aggregate R&D underinvestment.

KEYWORDS

Creative destruction, Endogenous growth, Monetary policy, R&D, Zero interest rate

JCR CLASSIFICATION

Q3

JEL CLASSIFICATION

O30;O40;E41

Journal of Money, Credit and Banking

https://doi.org/10.1111/jmcb.12929