ABSTRACT

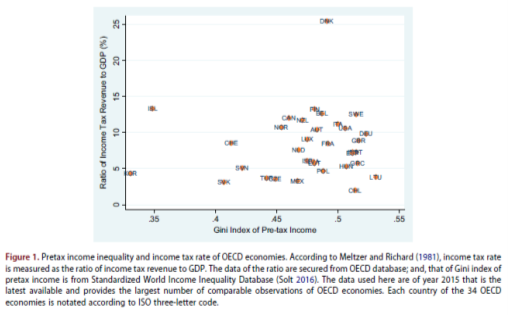

The Meltzer-Richard hypothesis maintains that higher pretax income inequality entails higher income tax rate chosen by majority-rule voting. However, empirical studies found evidence against the Meltzer-Richard hypothesis. This article reconsiders the Meltzer-Richard hypothesis by dropping their assumption of lump-sum transfers. It finds that the Meltzer-Richard hypothesis is not robust to relaxing the lump-sum transfer assumption. Without lump-sum transfers, the Meltzer-Richard hypothesis no longer holds, as the effect of pretax income inequality on politico-economic equilibrium income tax rate is no longer certainly positive.

KEYWORDS

Meltzer-Richard hypothesis, Pretax income inequality, Income tax rate, Lump-sum transfer

JEL CLASSIFICATION

D78; H24; D31

Applied Economics

https://doi.org/10.1080/00036846.2022.2057911