ABSTRACT

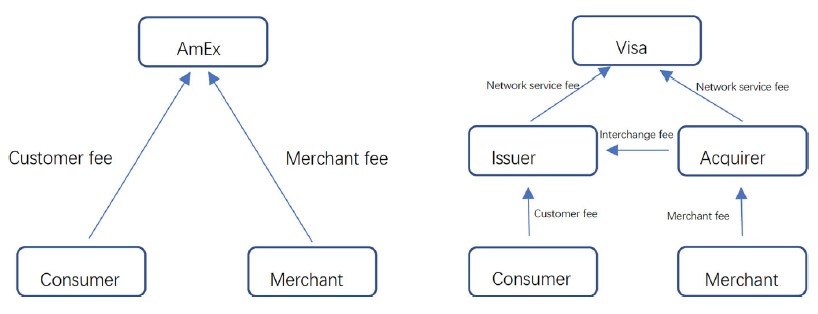

This paper provides a theory on how to regulate the level of merchant fees in credit card markets. In particular, we discuss how to regulate the merchant fee in a closed payment system with heterogeneous merchants. We find that tourist test is not a valid approach. Our model suggests that the regulation should be based on costs of networks or banks and market elasticity. Moreover, we provide an alternative understanding on how to regulate the interchange fee in an open payment system. The initial public offerings of Visa and MasterCard do not merely change themselves from not-for-profit associations to for profit companies, but also change the mechanism in determining the fee level and structure borne by end users. These changes in industry urge an updated understanding of the optimality of interchange fees.

KEYWORDS

Merchant fees, Closed payment system, Regulation

JEL CLASSIFICATION

D42; E85; L14

Journal of Regulatory Economics

https://linkspringer.53yu.com/article/10.1007/s11149-020-09406-z