ABSTRACT

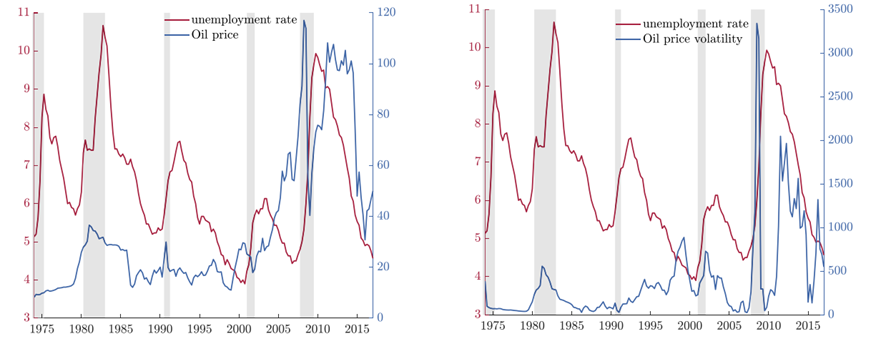

Although empirical evidence reveals a strong correlation between oil price volatility and unemployment, the transmission mechanism of these two variables is unclear. We theoretically examine the effects of oil price uncertainty shocks on the unemployment rate using a dynamic stochastic general equilibrium model incorporating a search-and-match component. We find that an unexpected increase in oil price volatility leads to a persistent increase in the unemployment rate. Comparing the oil price uncertainty shock with supply and demand uncertainty shocks in the final goods market, we observe that the oil price uncertainty shock has effects analogous to those of the supply uncertainty shock. In addition, we demonstrate that oil as a production input mitigates the adverse effects of uncertainty shocks to supply and demand sides of final goods market.

KEYWORDS

DSGE model; Oil price uncertainty; Demand shocks; Supply shocks; Uncertainty shocks

JCR CLASSIFICATION

Q1

JEL CLASSIFICATION

E32; Q52; Q58

Economic Modelling

https://doi.org/10.1016/j.econmod.2022.105935