ABSTRACT

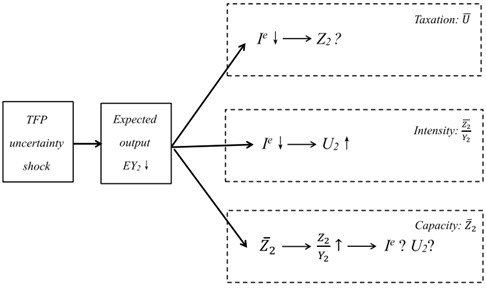

Prior literature on carbon policy analysis in a random environment focused on the existence of the level (first-moment) shocks, while recent research (e.g. Bloom (2009)) has emphasized the nonnegligible impact of uncertainty (second-moment) shocks on the macroeconomy. We study the mechanism by which an uncertainty shock affects carbon emissions, and how it interacts with different carbon policies by using a two-period model that yields a tractable and analytical solution. Due to the irreversibility of abatement investment, firms that are averse to uncertainty reduce their abatement investment as productivity uncertainty increases, which in turn reduces the abatement efficiency. However, greater uncertainty discourages production and reduces carbon emissions, which is consistent with the pattern observed in the data. By comparing social welfare across carbon taxation, intensity, and capacity regimes, we show that a carbon intensity target is the best policy and can simultaneously stabilize carbon emission and intensity. Carbon taxation and capacity regimes would both inevitably raise the carbon intensity level as productivity uncertainty increases.

KEYWORDS

Carbon policies; Productivity uncertainty; Business cycles

JEL CLASSIFICATION

E32; Q51; Q52

Technological Forecasting & Social Change

https://doi.org/10.1016/j.techfore.2020.120165