ABSTRACT

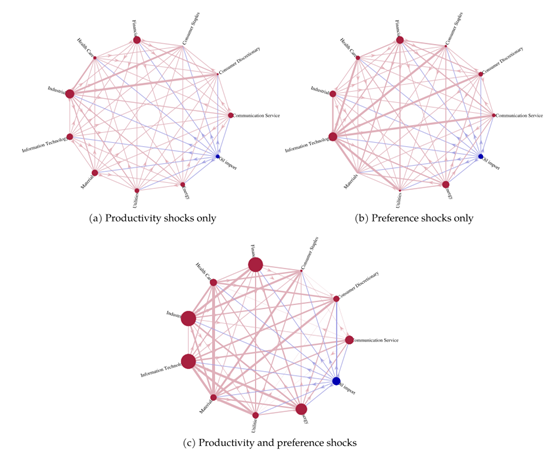

This paper examines the connectedness between oil and stock markets using the WTI oil price and 10 S&P 500 price subindices data from 1989 to 2021. We present a novel approach for constructing a connectedness index based on a dynamic stochastic general equilibrium (DSGE) model with Bayesian estimation technique. In contrast to existing approaches, our DSGE-based approach has the advantage of (i) incorporating a large number of shocks and effectively distinguish the demand and supply shocks to both oil and stock markets; (ii) allowing the conduction of policy and welfare analyses. By estimating the DSGE model, we find that demand shocks to oil and stock markets produce significant spillover effects compared to the supply shocks. We also show that the role of demand and supply shocks differ largely across sectors. We propose an oil-tax policy rule that can reduce the interconnectedness between oil and stock markets. The optimal oil tax rate that balances the tradeoff between systematic risk and social welfare is computed.

KEYWORDS

Oil shocks; Connectedness; DSGE model; Bayesian estimation

JCR CLASSIFICATION

Q2

JEL CLASSIFICATION

E32; G15; Q43; Q48

International Review of Economics and Finance

https://doi.org/10.1016/j.iref.2023.04.014