ABSTRACT

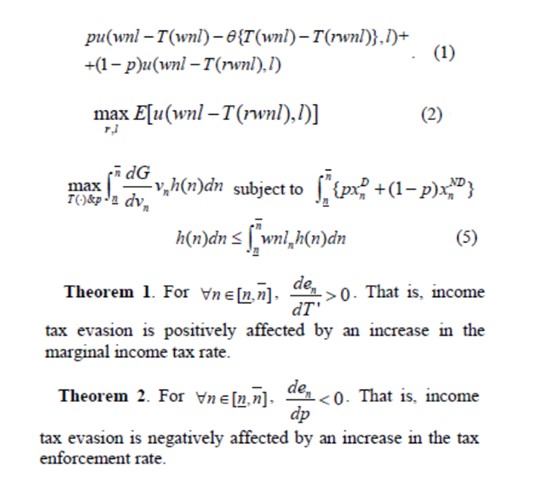

This paper resolves two lingering theoretical ambiguities on how income tax evasion is affected by income tax rates and by probability of detecting the tax evasion (tax enforcement rate). Improving upon the models of previous studies that showed the ambiguous effect of income tax rate and tax enforcement rate on tax evasion, the model of this paper allows taxpayers to decide both tax evasion and labor supply, responding to nonlinear income tax schedule and enforcement rate, while it also allows the government to decide both tax schedule and tax enforcement rate. With endogenous labor supply and tax evasion of taxpayers as well as endogenous decision of the government on tax rates and tax enforcement rate, the model of this paper more general than the models of previous studies. With this general model, we resolve the ambiguity as follows. First, we show that income tax evasion always responds positively to an increase in the income tax rate. Second, we also prove that income tax evasion is always negatively affected by an increase in the rate of tax enforcement, which invalidates the puzzling case that enhanced tax enforcement can increase income tax evasion.

KEYWORDS

Effect of Tax Rate on Tax Evasion; Effect of Tax Enforcement Rate on Tax Evasion; Nonlinear Income Taxation in Presence of Tax Evasion

JEL CLASSIFICATION

H26; H21; H24

Advances in Economics and Business

DOI: 10.13189/aeb.2018.060407

https://doi.org/10.1016/j.jclepro.2019.05.001