ABSTRACT

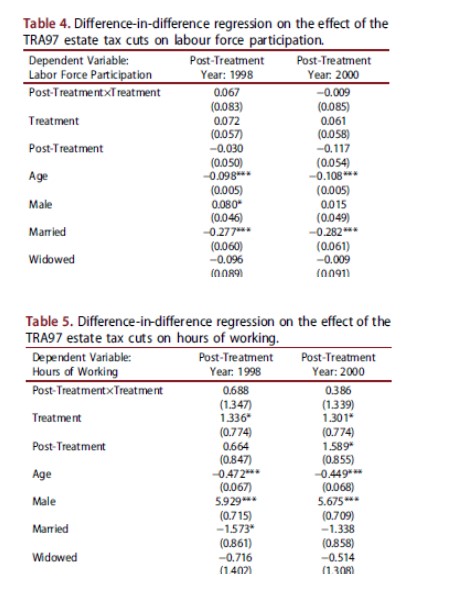

Exploiting estate tax cuts from the Taxpayer Relief Act of 1997 (TRA97), this paper estimates the effect of death tax on the labour supply of living potential donors. To this end, difference-indifference with multiple imputation approach is applied to micro-level panel data. This paper finds that the estate tax cuts makes no difference in labour force participation or working hours of potential donors in a statistically meaningful way, although the TRA97 reduces marginal estate tax rates by 37.51% on average. This finding suggests that the death tax causes no meaningful distortion of living potential-donors’ labour supplies at either extensive or intensive margin.

KEYWORDS

Estate taxation; Labor force participation; Working hours

JEL CLASSIFICATION

H24; J22; H30

Applied Economics

https://doi.org/10.1080/00036846.2019.1626344

https://doi.org/10.1016/j.jclepro.2019.05.001