cms_br_placeholder

ABSTRACT

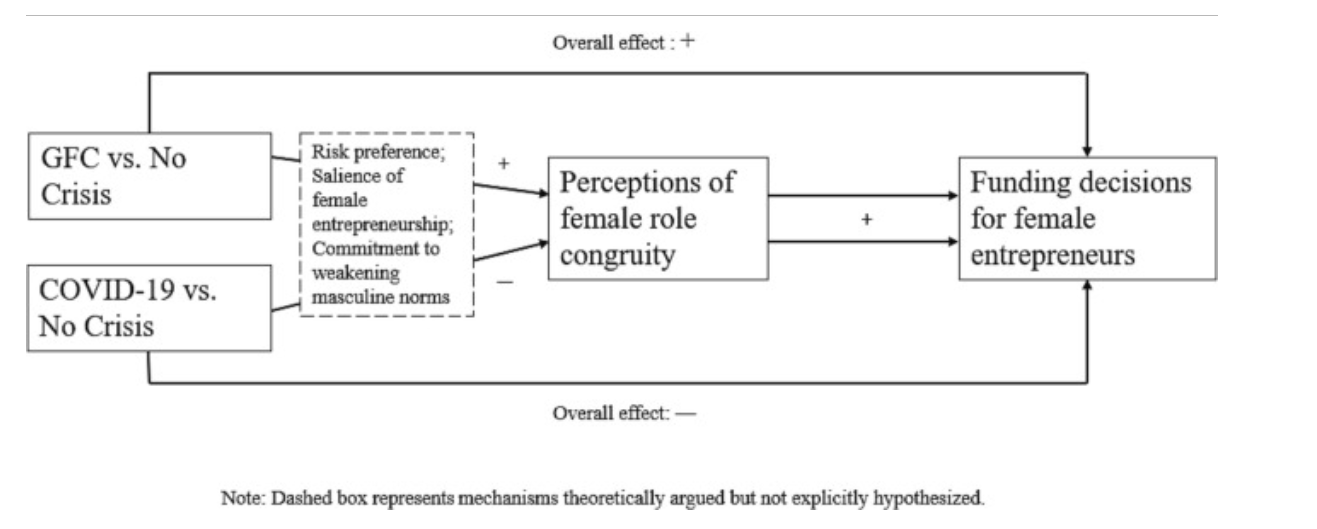

Crises have significant implications for entrepreneurs' businesses. Female entrepreneurs are often found to suffer from crises due to their marginalized positions. Despite the increasing research at the nexus of crisis, entrepreneurship, and gender, how a crisis may influence investors' funding decisions concerning female entrepreneurs and whether different macro crises bring with them different implications remain under-explored questions. Drawing on role congruity theory and the crisis and strategic decision-making literature, this paper proposes that macro crises can shake the perceived incongruity between traditional stereotypes of the female gender role and masculine stereotypes related to the entrepreneur's role, thereby affecting financing for female entrepreneurs. We further compare two specific crises having different associated implications: the global financial crisis (GFC) and the COVID-19 pandemic. We conducted two studies, one emphasizing experimental manipulation and the second based on observational data. We found consistent evidence that investors were more likely to invest in female-founded ventures after the GFC; however, the opposite phenomenon occurred after COVID-19. Our experiment demonstrates that changed perceptions of gender role incongruity are a critical underlying mechanism driving our results. Our research has implications for both the entrepreneurship literature and role congruity theory.

KEYWORDS

Gender;Entrepreneurial financing;Crisis;Gender role congruity;Covid-19;Global financial crisis

JCR CLASSIFICATION

Q1

Journal of Business Venturing

https://doi.org/10.1016/j.jbusvent.2024.106379