ABSTRACT

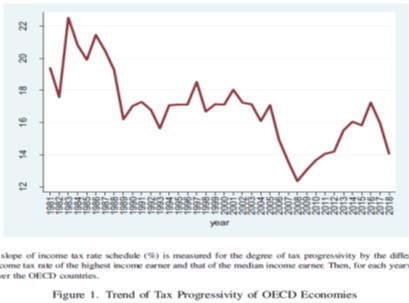

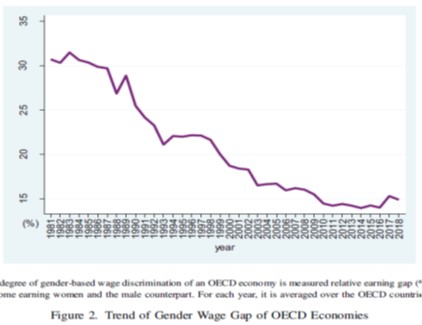

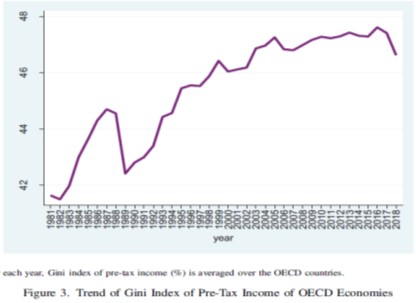

How does wage discrimination affect tax progressivity? To address this, optimal tax progressivity is characterized in an economy where individuals have different levels of ability and some of the individuals face wage discrimination. A decrease in wage discrimination reduces optimal tax progressivity, while an increase in ability inequality raises it. When pre-tax income inequality increases, tax progressivity can decrease. Moreover, interaction effect on tax progressivity of wage discrimination and ability inequality is negative. These findings hold whether social planners or voters decide tax progressivity. The empirical analysis with panel data of Organisation for Economic Co-operation and Development economies provides evidence supportive of the theoretical findings.

KEYWORDS

Tax progressivity; Wage discrimination; Pre-tax income inequality

JEL CLASSIFICATION

J71, H21, H24

Singapore Economic Review

https://doi.org/10.1142/S0217590821500661