ABSTRACT

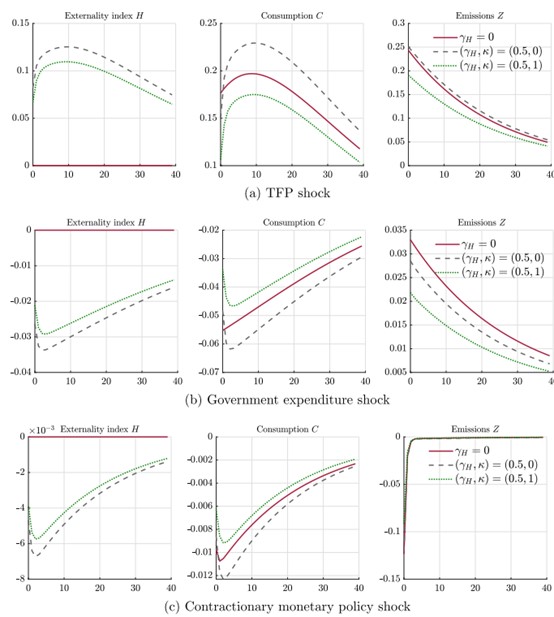

The existing climate models ignore the behavioral anomalies of households and conclude that the optimal environmental tax rate should comove with business cycles. However, this assumption has received extensive criticism recently. To this end, this paper studies the optimal emissions tax rate when households are bounded rational. In particular, we calculate the optimal climate policy in a dynamic stochastic general equilibrium (DSGE) model that features households with habit formation (internal habits) and social comparisons (external habits). Compared to the benchmark model without consumption externality, the social comparisons model amplifies consumption volatility but produces a similar response of pollutant emissions in the presence of the three types of economic shocks considered. In contrast, the habit formation model decreases the volatility of both consumption and pollutant emissions. In contrast to the previous result that the optimal emissions tax rate should be procyclical, we find that the social comparisons model largely mitigates the procyclicality of optimal emissions tax rates, and the optimal emissions tax rates under the habit formation model remain constant in response to all the economic shocks considered.

KEYWORDS

Emissions tax rate; Habit formation; Social comparisons

Energy Policy

https://doi.org/10.1016/j.enpol.2020.111809