ABSTRACT

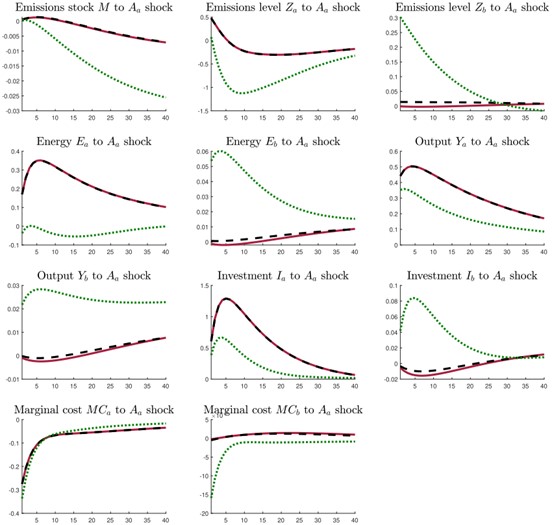

Existing literature on climate policy analysis in an international environmental agreement does not condition the optimal policy on the economic conditions of the countries. This paper constructs a two-country environmental dynamic stochastic general equilibrium (E-DSGE) model to compare the optimal carbon tax rates between countries in noncooperative and cooperative scenarios in the presence of different economic shocks. Compared to those in the cooperative scenario, countries without cooperation would have an optimal carbon tax rate that increases less in response to a positive home-country total factor productivity (TFP) shock and decreases more in response to a positive energy price shock. Further, in the noncooperative scenario, the carbon tax rate decreases in response to the foreign-country TFP shock, but to a lesser extent than that in the cooperative scenario. Countries’ cooperation does not necessarily lead to a lower emissions stock. It decreases only in response to positive home- and foreign-country TFP shocks, and it increases in response to a positive energy price shock.

KEYWORDS

Carbon tax; E-DSGE model; Energy price shock

JEL CLASSIFICATION

Q53; E32; R23

Journal of Cleaner Production

https://doi.org/10.1016/j.jclepro.2020.120452