ABSTRACT

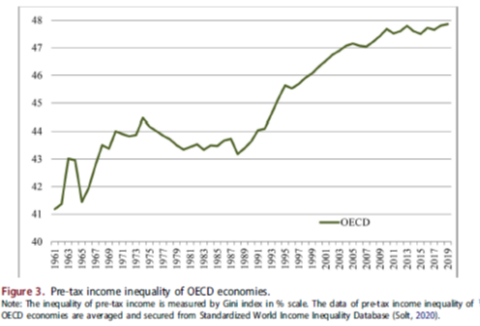

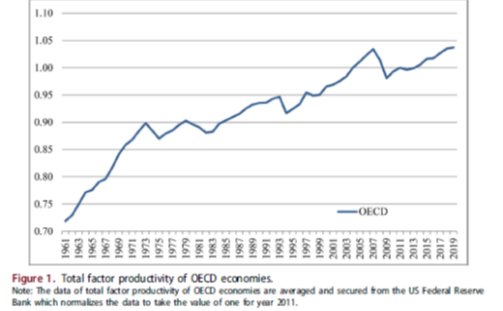

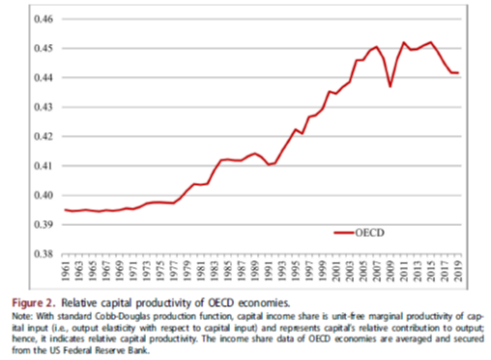

Facing technological progress, how should a government reform income taxation? To address this question, optimal capital and labor income taxation is obtained for an economy of heterogeneous individuals. Technological progress raises optimal capital income tax rate and lowers optimal average marginal labor income tax rate if it is capital-biased by increasing relative capital productivity. Technological progress does the opposite if it is labor-biased by decreasing relative capital productivity. Neither capital-biased nor labor-biased technological progress affects optimal slope of labor income tax rate schedule. Technological progress does not affect optimal income taxation if it is unbiased by preserving relative capital productivity.

KEYWORDS

Capital-biased technological progress, Unbiased technological progress, Optimal income taxation, Relative capital productivity

JEL CLASSIFICATION

H21; O33; H24; E25

Economic Research

https://www.tandfonline.com/doi/full/10.1080/1331677X.2022.2142828