Meng Han, Lammertjan Dam, Walter Pohl

ABSTRACT

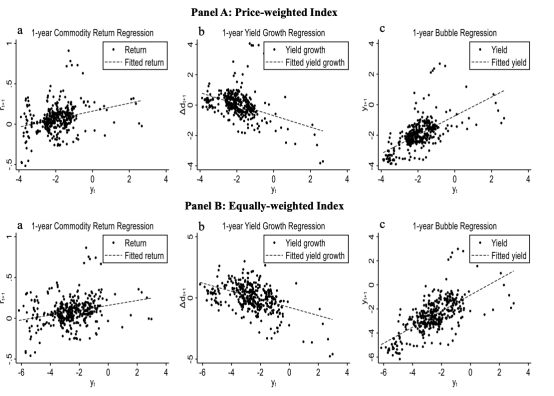

We investigate the importance of time-varying discount rates for commodity prices using an index based on twenty-three commodities for the period 1959–2024. We show that in commodities markets, unlike other financial markets, time variation in discount rates plays a much smaller role. Instead, prices forecast cash flows as well as discount rates. A high price for a commodity today, measured as a low percentage net convenience yield, forecasts both a high future convenience yield and a low expected return. For longer horizons, variation in percentage net convenience yields seems mainly driven by net convenience yield growth, making commodities much closer to the classical textbook view of price changes representing news about cash flows.

KEYWORDS

convenience yield; commodity price variation; commodity return predictability.

JCR CLASSIFICATION

Q1

Journal of Review of Finance

https://doi.org/10.1093/rof/rfae043