Xi Chen , Junbo Wang , Chunchi Wu , Di Wu

ABSTRACT

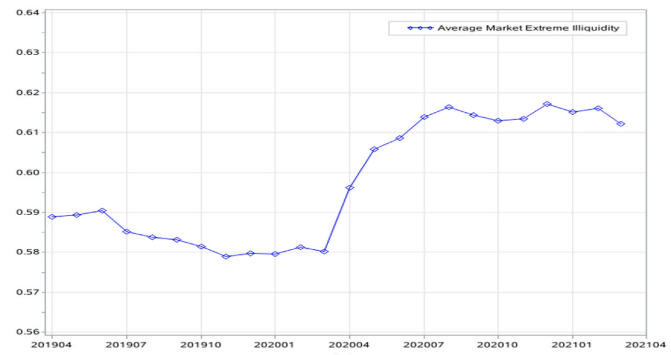

Corporate bonds carry an extreme illiquidity (EIL) premium. This premium permeates all rating categories and heightens during financial crises and periods of high uncertainty. EIL has predictive power in the cross-section for future returns up to at least one year. Active investors like mutual funds prefer low EIL bonds that can be easily liquidated during times of stress, whereas passive institutional investors overweight high EIL bonds to receive the EIL premium. While adding an EIL factor constructed from portfolios to the factor model increases the explanatory power, its effect is largely subsumed by bond-level EIL in a horse race.

KEYWORDS

Extreme illiquidity; Corporate bond pricing; Ratings; Financial crisis; Tail risk

JCR CLASSIFICATION

Q2