近日,北京师范大学湾区国际商学院特聘副研究员韩梦博士以独立作者身份在金融衍生品领域重要期刊《Journal of Futures Markets》上发表了题为《Commodity momentum and reversal: Do they exist, and if so, why?》的研究论文。

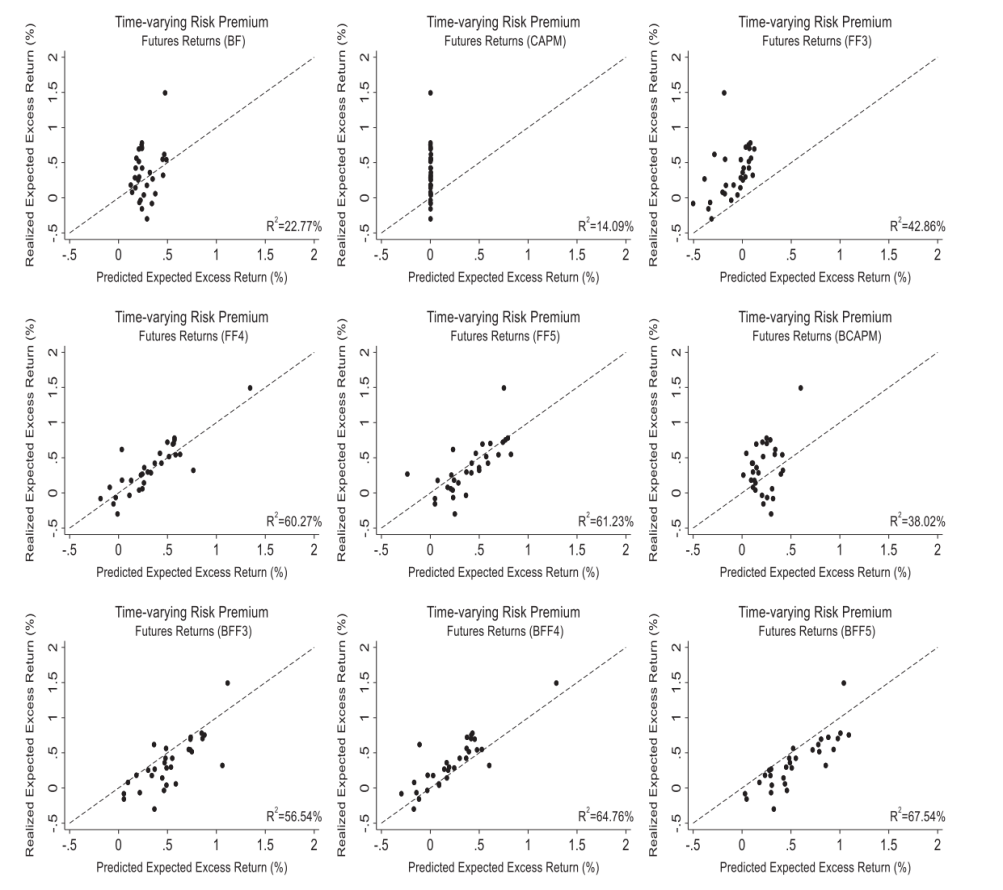

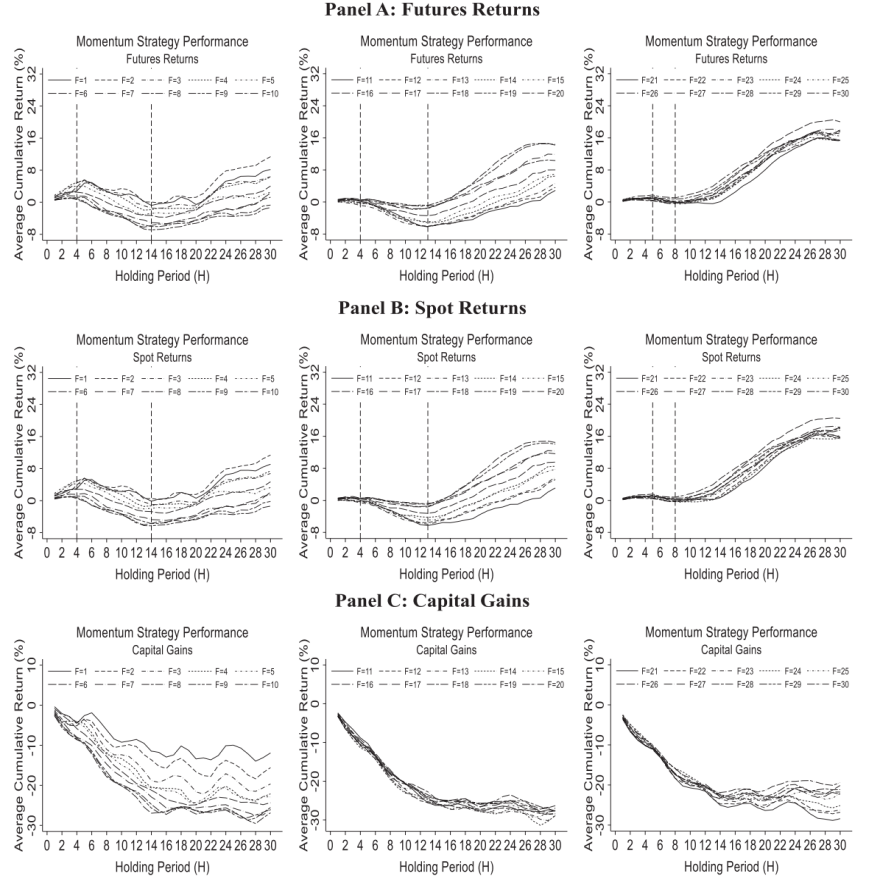

本文主要研究商品市场的动量与反转效应。通过利用23种商品近60年的数据构建动量策略,发现现有研究得出的有关商品现货与期货市场上不同的动量与反转效应是由商品现货收益的定义导致的。本文发现一旦商品现货收益包含了净便利收益,在商品现货和期货市场上就会存在一致的动量与反转效应:首先是动量效应,其次是反转效应,再其次是动量效应。该动量与反转效应模式可以从风险—收益的角度由传统资产定价风险因子和净便利收益相关的风险因子(basis)解释。

论文摘要:

Questions as to why differences in momentum and reversal patterns seem to emerge in commodity futures compared with spot markets, and how these patterns can be explained, remain unanswered. To investigate these questions, I examine 23 commodities over a period of 60 years. I first show that including the net convenience yield in the definition of commodity spot returns reconciles the differences in the results for commodity spot and futures markets. Both commodity futures and spot markets exhibit quantitatively consistent momentum and reversal effects. An initial momentum effect is followed by a reversal effect and then another momentum effect. These observed patterns in commodities can be jointly explained by a combination of traditional asset pricing factors and a basis factor related to the net convenience yield.